Leveling Up Part I of III: How I earned a 40% return in the gaming market & what's next

Setting the Scene: The Gaming Landscape in Mid-2025

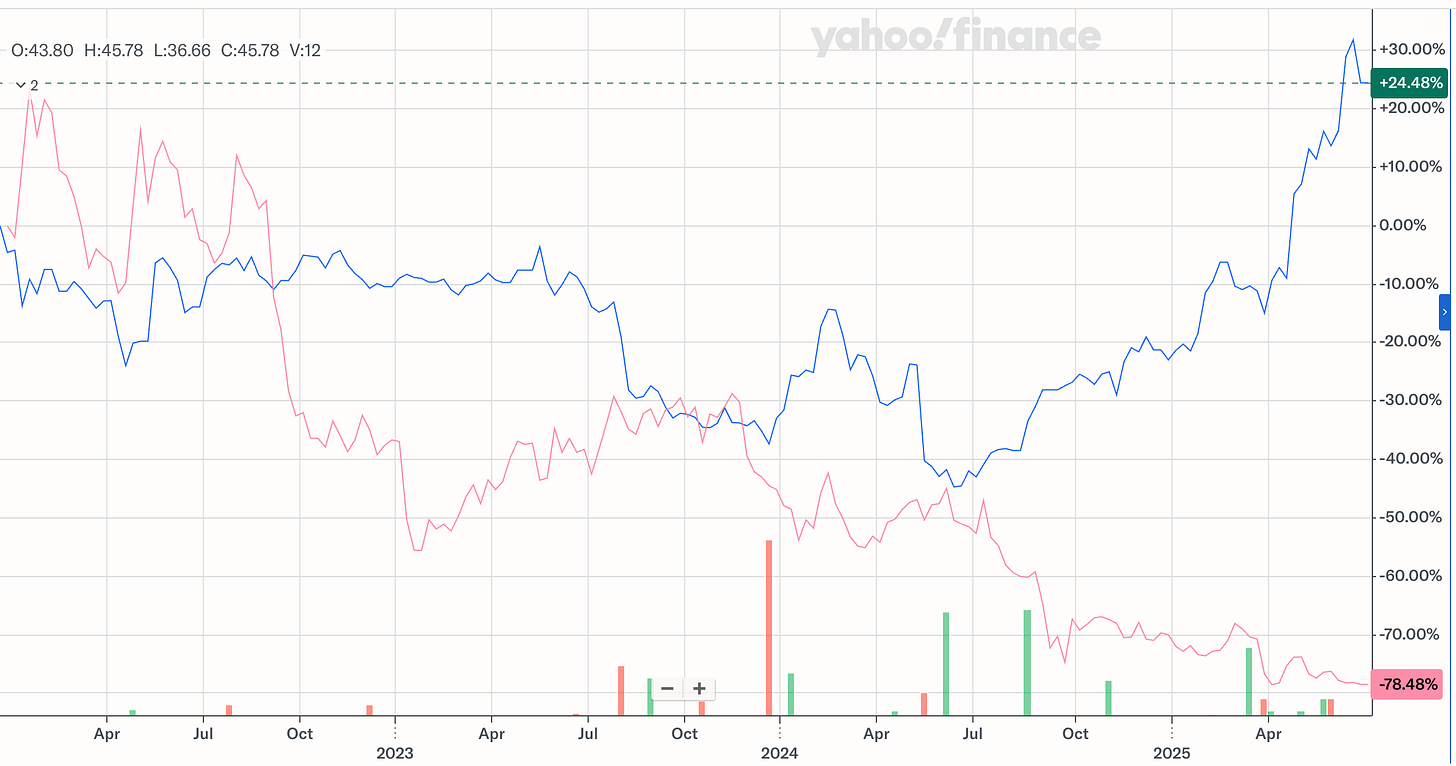

Greetings all! I will be producing a series on the gaming industry, starting with where the gaming industry is today, what the plans are for the future, and who the major players are. Given the bredth and depth of the gaming market, this series will focus exclusively on the console and pc gaming segment and the opporunities there. It will serve as a guide to how I identify the best value stocks in gaming, as illustrated by the performance shown below:

The three gaming companies shown in the chart above were the exclusive gaming companies included on my stockpicking trade piece. Lets begin the deep dive:

Current gaming landscape

The gaming world has developed strongly over the past few decades. From humble beginning as arcade machines found in shopping malls, it’s evolved to outpace the movie and music combined in terms of total revenues home to platforms-as-an-ecosystem, recurring monetization models, and contian IP franchises that value, rivals those in hollywood. However, as with any maturing industry, not all gaming stocks are created equal, and timing matters more than ever.

Coming off a rocky 2022–2023 cycle defined by post-COVID hangovers, inflationary cost spikes, and cautious consumer spending, the industry is now approaching a major inflection point. Hardware cycles are turning. Flagship IPs are gearing up for big releases, and investors are once again paying attention, just not in a particularly discerning or knowledgable way.

This series will begin by conducting a case study on two titans, Square Enix and Ubisoft, predominately known for the Final Fantasy and Assassin’s Creed series, and how they have taken differnet approaches and seen different results over the previous decade. It will then unpack three companies that deserve your attention, not as broad bets on gaming, but as asymmetric, time-sensitive trades with distinct catalysts and risk profiles. In addition to doing a case study on two relatively similar gaming companies and their evolution over time. The three trades we will be covering are:

Nintendo: The patient bull trade

Take-Two Interactive: The mispriced blockbuster

CD Projekt Red: The sleeper rerating

Each of these three stocks have performed positvely, since the start of 2025 (see first chart) so I am excited to share my valuation methodology and analysis in depth in part 3. With that said lets begin on industry context in no particular order:

Industry Basics (101: Refresher)

Hardware reset is overdue: The PlayStation 5 and Xbox Series X/S are nearly five years old. Nintendo’s Switch is approaching vintage status. Investors are eyeing new console announcements as key catalysts for both hardware and software revenue boosts.

IP > Everything: Gaming IP is now being leveraged across TV (The Last of Us, Fallout), film (Mario, Sonic), and streaming. Publishers with strong IP, and the ability to refresh or remonetize it have outperformed.

Macro tailwinds: Inflation is easing, labor markets are stabilizing, and discretionary spending is slowly recovering. This supports a more bullish tilt for consumer cyclical names.

AAA has leveled up to AAAA: The rise of "quadruple-A" games (e.g., Starfield, Red Dead Redemption 2, the next Witcher) reflects ballooning budgets, longer dev cycles, and sky-high expectations. These titles are event-driven spectacles, and only a handful of studios can now afford to make them. Consolidation across gaming industries.

Live service saturation: Publishers are chasing Fortnite-style recurring revenue with multiple live service bets but only a few will stick. Investors must separate the true franchises (Warzone, Helldivers) from overfunded fads (Concord).

Free-to-play and microtransaction dominance: Monetization has shifted decisively toward skins, season passes, and in-game economies. The upfront $60 price tag is no longer the primary business model, especially in competitive and mobile-first markets.

Indie renaissance and AA extinction: While high-quality indie titles (like Hades, Dave the Diver, or Hollow Knight) continue to punch above their weight, the mid-tier AA space is rapidly vanishing. Rising costs and consumer expectations are creating a barbell dynamic: massive franchises on one side, agile indies on the other.

The Ubisoft Warning: Few companies illustrate the cost/return imbalance better than Ubisoft. Once a prolific mid-to-top-tier developer, it now finds itself trapped in a cycle of ballooning budgets, repeated delays, and lukewarm reception. Flagships like Assassin’s Creed and Skull & Bones have lost momentum, while internal restructurings and missed expectations have crushed investor confidence. It’s a cautionary tale of what happens when cost inflation outpaces creative payoff. Square Enix offers a contrasting path: by pivoting toward smaller, more frequent titles alongside core franchises, it's managed to diversify risk and regain creative traction without betting the house on every release.

Break-even is now blockbuster-level: In previous console generations, a game selling 1–2 million units was considered a success. Today, due to skyrocketing production and marketing budgets, many AA and AAA titles need to clear 5–10 million units just to break even; a staggering shift in risk and return that has squeezed mid-tier studios and made every release a potential make-or-break event.

AI and dev productivity: Tools like Unity’s Muse, procedural generation, and generative dialogue systems are lowering the cost (and time) of AAA development for the best-managed studios.

M&A and consolidation: The post-Activision-Microsoft deal environment is quieter but still ripe for mid-cap takeouts. Studios with clean IP portfolios and strong cash flow are potential targets. Another notable example is the Activor Investment in square-enix (see upcoming article).

The walls between console, PC, and mobile are breaking down. Cross-platform titles are now table stakes, and studios are increasingly designing games with broad hardware agnosticism in mind. At the same time, cloud infrastructure is quietly transforming distribution and gameplay delivery — laying the groundwork for broader audience reach and lower marginal costs. Studios that bake platform-agnostic design into their development DNA are better positioned for survival.

Demiographics: Gaming’s global audience is evolving. Mobile-first, casual, and younger gamers are now the dominant segment by sheer volume, particularly in regions like Southeast Asia, Latin America, and parts of Africa. Meanwhile, older gamers, returning players, and PC/console enthusiasts continue to drive spending per user, premium game sales, and high-end hardware adoption I don’t know much about the first, so focus will naturally be on the second.