Global Rotation? Lessons from History for Today's Markets

A slowing U.S. earnings outlook is flashing caution, but history suggests investors should be careful before betting on a full global equity rotation.

In financial markets, history can rhyme, but it rarely repeats exactly. Today, a wave of softening U.S. earnings expectations is stirring talk of a potential global equity rotation: a shift where international stocks outperform U.S. markets.

While the narrative feels familiar, it’s important to revisit the facts.

Historically, collapses in U.S. forward earnings expectations have sometimes preceded periods of international equity outperformance — notably in the early 2000s. However, over the past 15 years, the relationship has weakened. Since the 2008 Global Financial Crisis, U.S. equities have maintained leadership even during episodes of earnings softness.

📊 A Look Back: When Did Global Markets Outperform?

In the early 2000s (2000–2007), international equities did outperform U.S. equities. After the bursting of the dot-com bubble, the U.S. struggled with earnings stagnation, while international markets, driven by commodity booms and global expansion, took the lead.

However, after the 2008 Global Financial Crisis, the landscape changed. Despite occasional global earnings resilience, U.S. equities regained and held dominance, fuelled by:

Unmatched tech sector growth

Aggressive monetary stimulus

Stronger earnings recovery vs. the rest of the world

Since then, even during periods of U.S. earnings soft patches, international markets have not sustained outperformance.

🔢 Corrected Historical Pattern

In the early 2000s, collapsing U.S. earnings coincided with international outperformance.

Post-2008, U.S. leadership has remained dominant even through global earnings wobbles.

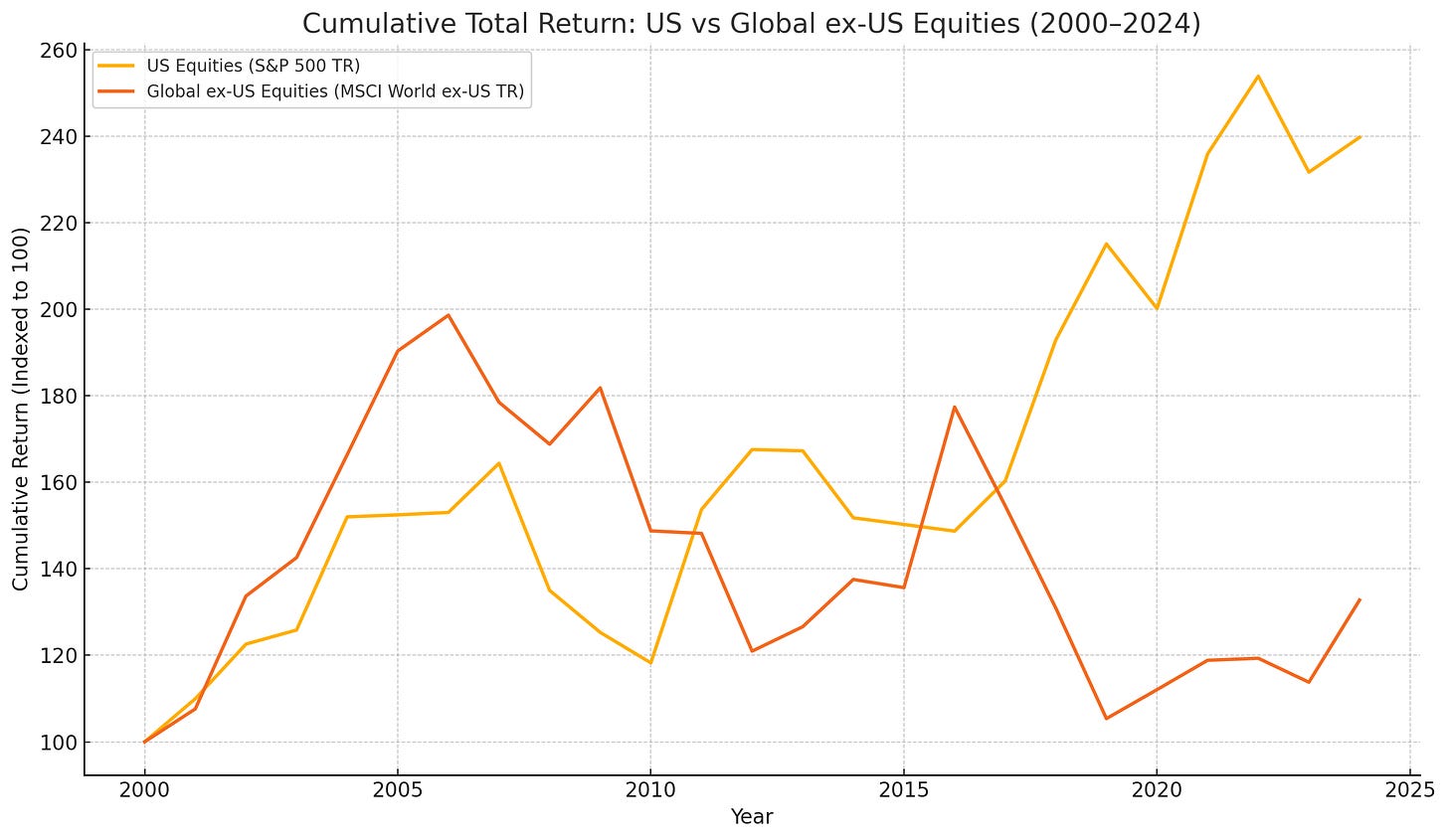

📊 Cumulative Total Return: 2000–2024

2000–2007: Global ex-U.S. equities outperformed

2008–2024: U.S. equities (S&P 500) dramatically outperformed

Key Insight: A U.S. earnings slowdown today does not guarantee a repeat of early 2000s-style global outperformance. However, valuations between US and Global equities look stretched.

🔹 What Investors Should Watch

Relative earnings momentum between U.S. and international companies.

Currency moves: A weaker dollar could enhance international returns.

Valuation gaps: International equities remain significantly cheaper than U.S. equities on PE and CAPE ratios.

🔹 Final Thought: Proceed With Nuance

The setup for a global rotation is there — but unlike past cycles, investors need to be selective.

Focus on regions and sectors with true earnings leadership, not just valuation discounts. The age of "buy anything non-U.S." may be over; targeted exposure is key.